In terms of paying for a motor vehicle, lots of individuals think about the choice of buying from the applied car or truck dealership. This alternative is frequently inspired by the desire to economize, as made use of autos generally arrive in a lower cost level than brand-new kinds. A dependable utilised vehicle dealership provides a big choice of autos that have been comprehensively inspected and so are ready for resale. This provides consumers reassurance recognizing the vehicle They can be investing in has gone through arduous checks to be sure its trustworthiness. The charm of made use of automobiles is not merely limited to their affordability; Furthermore, it extends to The variability of versions out there, enabling people to locate a automobile that fulfills their unique requirements and Choices. Whether a person is looking for a compact car or truck for town driving or a bigger SUV for family members outings, a utilised car or truck dealership is probably going to obtain a number of alternatives that in shape the Invoice.

The whole process of obtaining a vehicle from the made use of car dealership frequently entails the need for vehicle loans. These financial loans are necessary for people who do not need the signifies to purchase an automobile outright. Numerous utilized vehicle dealerships offer funding selections for making the getting approach smoother for their customers. Motor vehicle loans are typically structured in a method that permits purchasers to pay back the price of the car over time, which makes it less difficult to deal with fiscally. Interest premiums on automobile financial loans could vary according to the buyer's credit rating history, the bank loan term, along with the lender. It's important for likely purchasers to thoroughly think about the phrases of your mortgage right before committing, as this may have a big influence on their monetary obligations while in the years to come.

For anyone that has a less-than-excellent credit rating record, securing funding through negative credit score auto financial loans may very well be necessary. Poor credit score automobile loans are especially made for individuals who may have struggled with credit rating troubles before. These loans typically include greater interest rates because of the elevated risk car loans perceived by lenders. However, they offer a chance for people with bad credit history to rebuild their credit rating score while continue to acquiring the automobile they require. When dealing with a utilised automobile dealership, it's not unusual to discover funding possibilities tailored to support purchasers with lousy credit rating. These dealerships comprehend the difficulties confronted by folks with poor credit rating and often associate with lenders who specialize in undesirable credit history automobile financial loans, ensuring that far more folks have access to the automobiles they need.

One more vital consideration when getting a made use of vehicle is used cars the potential for auto refinancing. Automobile refinancing lets motor vehicle proprietors to exchange their recent car personal loan with a new a single, perhaps securing superior conditions for instance a lessen desire rate or a far more workable every month payment. This may be significantly beneficial for those who initially took out bad credit history motor vehicle financial loans but have due to the fact enhanced their credit score score. By refinancing, they could possibly cut down their money load and save cash above the life of the personal loan. Applied auto dealerships usually function with refinancing experts that can help their buyers investigate these choices. The intention of car or truck refinancing is to produce car possession much more economical and sustainable in the long term, allowing folks to maintain their fiscal wellness although even now savoring some great benefits of proudly owning a vehicle.

During the employed motor vehicle industry, The provision vehicle refinancing of various financing selections, including auto financial loans and lousy credit score auto financial loans, is very important for ensuring that an array of customers can obtain the motor vehicles they require. Employed auto dealerships Enjoy an important role in facilitating these transactions by providing flexible financing options and partnering with lenders who're willing to function with consumers of all credit score backgrounds. The option to go after vehicle refinancing further boosts the enchantment of shopping for from a employed automobile dealership, as it provides a pathway for buyers to further improve their economical problem eventually. By thoroughly thinking of most of these aspects, people can make educated choices when purchasing a made use of auto, making certain which they uncover the proper auto in a cost they might manage.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Lynda Carter Then & Now!

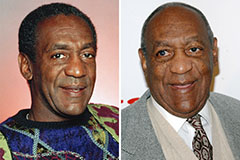

Lynda Carter Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!